The 10 Biggest Shark Tank Food Fails, Ranked

With more than 300 episodes aired since 2009, ABC's "Shark Tank" is one of the most popular and enduring reality shows of all time (via Imdb). That's likely due in part to the show's high stakes and real-world implications. In each episode, business owners, inventors, and entrepreneurs enter the "tank" to pitch a panel of high-profile and extremely successful investors and venture capitalists on their big idea. If they can convince the panel of their product or concept's ingenuity, market viability, and utter profitability, they'll get what they came for — a windfall of operational money in exchange for a share of the business.

More often than not, a "Shark Tank" episode will feature a pitch from a small business owner looking to break into the highly competitive sector of packaged foods and beverages. Some of them go on to wild success, with or without a deal from "Shark Tank." Others begin their slow demise right there on TV. Here are the most spectacular food product flops ever to be featured on "Shark Tank."

10. HotShot was an unnecessarily complicated caffeine delivery method

According to Shark Tank Tales, on a Season 7 episode of "Shark Tank," entrepreneur Danny Grossfeld was willing to give up a 10% stake in exchange for a $300,000 financial boost to expand his business. Grossfeld told the Sharks that he had spent six years and $2 million developing HotShot. Unlike the many canned coffees on the market that are served cold, HotShot's containers keep the drink inside at a piping hot 140°F with the assistance of a proprietary heating unit.

Before heading to "Shark Tank," Grossfeld tried to get $100,000 of working capital from Kickstarter and failed to do so (via Shark Tank Success). He also admitted that HotShot hadn't made him any money at all in three years. "If you can't make money in 36 months, take it behind the barn and shoot it," Kevin O'Leary quipped. Robert Herjavec cited the number of coffee shops in the U.S. that serve hot beverages with far less fuss and machinery than the HotShot required. Mark Cuban floated the offer of distributing the coffee cans (and appliances) to his chain of Landmark Theaters, but ultimately no deal was suggested or completed. After the show, HotShot seemed to fizzle.

9. Henry's Humdingers got the deal, lost the deal, then lost everything

Henry Miller certainly amused the panel of sharks when he appeared on "Shark Tank" in Season 5 pitching his business Henry's Humdingers. The teenager first hit the stage in a beekeeper suit (via YouTube) and then explained that he'd been tending to bees since he'd received a hive for his 12th birthday and wound up with way too much honey. He converted that raw honey into a line of products that hit big in the natural foods sector, with placement in more than 100 stores in 31 states. Miller also added an emotional call to action, reminding the Sharks and viewers of the ongoing crisis of worldwide bee population declines.

To expand his rapidly growing business even more, Miller wanted a $150,000 investment, for which he was willing to part with 25% of his company. Negotiations ensued, and per the Bellingham Herald, Miller agreed to accept $300,000 for a hefty 75% stake split between Mark Cuban and Robert Herjavec. But after the episode finished taping, Miller backed out of the deal. Business tripled, but the founder had little choice but to shutter the company in January 2019, per a Facebook post, due to rising costs, his mother's cancer recovery, and a fire that destroyed his farmhouse.

8. Luma Soda didn't pop for the Sharks

Entrepreneur and former trial lawyer Jim Otteson aimed to create a healthier alternative to sugary sodas, according to Bizz Bucket. In 2017, he founded Luma Soda and took his products to "Shark Tank" in Season 10, seeking a $500,000 investment in exchange for a 20% portion of the company. Otteson manufactured his fizzy soft drink, sweetened with natural monk fruit and honey to cut down on the carb count, and made without artificial additives or preservatives, in four flavors: cherry, blood orange, lemon-lime, and cola.

According to Shark Tank Products, Otteson had his work cut out for him as a very late entrant in the multi-billion-dollar soft drink industry. And it's not like he acted like he was inventing diet soda — he pointed out to the Sharks that scientists at Yale had discovered that consumption of artificially sweetened calorie-free soda led to weight gain. He even blamed his own increasing weight on his diet soda habit. The investor panel wasn't moved by the quality of the product or Otteson's personal story. He didn't get the money he needed, and Luma Soda soon went defunct.

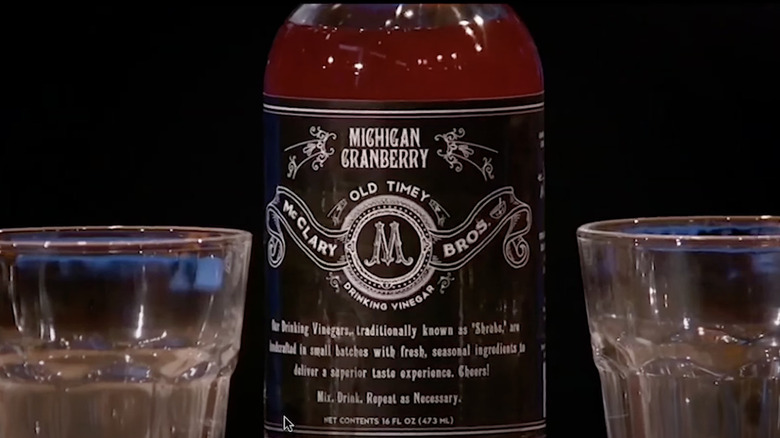

7. McClary Brothers Drinking Vinegars left a bitter taste in the Tank

Most people think of vinegar as an exceptionally sour substance, an ingredient in sauces and salad dressings, or as a versatile cleaning tool. However, drink manufacturers, the McClary Brothers, attempted to make vinegar into a successful beverage business. According to Shark Tank Recap, Jess Sanchez McClary explained that cocktails called shrubs, made from vinegar infused with juice and sugar were very popular in colonial America. Sanchez promised that the company's cranberry, beet and carrot, and Thai basil flavors paired great with sparkling water or as a mixer with an alcoholic spirit (via Shark Tank Products).

Sanchez-McClary made her pitch, seeking $100,000 for a 15% company stake (via Shark Tank Tales), However, the Sharks couldn't be convinced of the product's viability. A few liked the product when mixed with alcohol but found the taste of the drinking vinegar by itself to be very pleasant. That, along with concerns about the difficulty in convincing consumers what made these beverages different from pantry vinegar, meant that no deals were made that day. In 2018, Sanchez-McClary closed down McClary Brothers Drinking Vinegars.

6. My Fruity Faces couldn't stick around

Getting kids to eat healthy produce is an age-old and perpetual battle, and many companies and experts have tried to introduce the tools that they thought would help adults finally win the war over vegetables. To that end, Adam Gerber and Bob Ntoya created a company called My Fruity Faces to make fruits and veggies more fun (via Shark Tank Recap). The brightly-colored stickers, which were fully and completely edible, were designed to allow kids to decorate produce and make it more palatable.

According to Shark Tank Breakdown, My Fruity Faces had sold $125,000 worth of products in the three years prior to appearing on the show. To continue this growth, they asked the investors for a $200,000 cash infusion in exchange for a 10% stake. The My Fruity Faces founders claimed that they were negotiating for placement in Target. They had also secured a license to place Nickelodeon characters on stickers, but it had expired. The company was also nearly $200,000 in debt, an alarming fact to the sharks who refused a deal. With no one willing to give them the amount of money they desperately needed, My Fruity Faces wrapped up operations in 2018.

5. The Sharks didn't waffle long on their rejection of Wired Waffles

A lot of people drink coffee to perk up in the morning. And many of these people would love scratch-made waffles for breakfast. Roger Sullivan created Wired Waffles to simultaneously fill these two needs — heat-and-eat waffles laced with caffeine. However, the market wasn't really ready for the combination. Brands like Eggo long dominated that marketplace, and most caffeine-loving adults have a coffee-drinking routine to get their morning jolt each day.

Sullivan took Wired Waffles to "Shark Tank" (per Shark Tank Tales), asking for a $75,000 investment in exchange for a 25% share of his company. Kevin O'Leary didn't think Sullivan's sales figures to date were significant enough to justify an investment, and he also worried that a better-funded baked goods distributor could easily rip off the idea and sell their own caffeinated waffles. Lori Greiner and Mark Cuban suggested that the product posed inherent safety risks — like if a child, sensitive to caffeine, accidentally ate these otherwise normal-looking waffles. Sullivan left the tank no richer for the effort. In 2015, per BizzBucket, Wired Waffles went out of business, and Sullivan started a moonshine company.

4. Brewer's Cow Ice Cream melted

Few consumables are as widely beloved as beer — except for ice cream. Both are sought after on hot days and both are a great way to celebrate with friends. The rise of craft beer culture and bespoke ice cream brands like Ben and Jerry's have elevated both products to premium, high-end status. Each has devotees and entrepreneurs Steve Albert, Jason Conroy, and Larry Blackwell Jr., came up with an idea that aimed to straddle both worlds. Their trick — combine beer and ice cream.

Brewer's Cow Ice Cream's founding trio presented their creation on a Season 3 episode of "Shark Tank." As part of their presentation, per Shark Tank Products, they brought in a model dressed like a traditional Oktoberfest beer server, who passed out samples of their beer-infused frozen dessert to all the Sharks present. Lactose-intolerant Daymond Green refused to sample the stuff, so he wouldn't invest either. Mark Cuban admitted that he liked the taste of the product, but recommended that they partner with a brewery instead of trying to find success alone. Kevin O'Leary believed that the product would ultimately prove unsuccessful since the business had only grossed $5,000 in the year before. Even after exposure on national TV, Brewer's Cow struggled to gain traction and is no longer in business.

3. The cookie crumbled quickly for PMS Bites

According to ABC News, Tania Green tracked her moods over several years and found that she felt her worst when she was enduring symptoms of premenstrual syndrome. She often found herself giving in to her sugar cravings and dining on unhealthy sweet treats. Wanting to stay on course, she created PMS Bites, gluten-free, vegan, chocolate-based treats. Green took the snack to "Shark Tank" to seek the funds needed to expand her business. She asked the sharks for $50,000 in exchange for a 20% company share, according to Shark Tank Tales.

The Sharks wouldn't bite the cookie, according to Shark Tank Recap. Kevin O'Leary and Lori Greiner believed that the marketing strategy limited the potential audience. Mark Cuban was concerned about Green neglecting a strong online sales focus and Barabara Corcoran questioned her sales techniques. PMS Bites left the show without a deal and completely closed in 2018.

2. Cookie Kahuna wasn't a comeback hit for the formerly famous Amos

Wally Amos started his own cookie business in the 1970s with investments from superstars Marvin Gaye and Helen Reddy (via The New York Times). The company was a success, leading to Famous Amos becoming a multi-million dollar cookie pioneer. However, the founder sold the company and gave up his rights to use his own image to sell products. The demise led to the financial downfall of Wally Amos as the business struggled and he eventually lost his house.

Fast forward to 2016, when Wally Amos appeared on "Shark Tank" looking for a comeback. He pitched a $50,000 investment for a 20% stake in his new cookie venture, Cookie Kahuna (via Shark Tank Tales). However, each of the Sharks had a major issue with Amos's plan, and they bluntly told him as much. Barbara Corcoran criticized Amos for selling off the rights to his image decades prior, which denied Cookie Kahuna of a giant marketing hook. Robert Herjavec thought the cookies cost too much to make and that distribution channels weren't robust enough. Amos left the show without a deal and his second foray into the cookie biz ultimately failed.

1. The Sharks didn't like much about Cow Wow Cereal Milk

When your favorite breakfast cereal is gone, the milk remains in the bowl, taking on a nostalgic flavor. This is widely known as "cereal milk," and it's become a trendy sweet treat. According to Shark Tank Products, one of the businesses trying to make it in this market was a company called Cow Wow Cereal Milk, and its founders appeared on a 2014 episode of "Shark Tank."

Chris Pouy and Tiffany Panhilason sold a dairy-based beverage that was flavored to taste like the sweet drink left from cereal (via Shark Tank Tales). The founders approached the show to ask for a $250,000 investment in exchange for a 10% stake in the business. None of the sharks bit and the twosome left the show without a deal. They did see optimistic signs after their appearance with their product being stocked in major grocers like Kroger and City Market. However, the success didn't last and the business eventually closed.